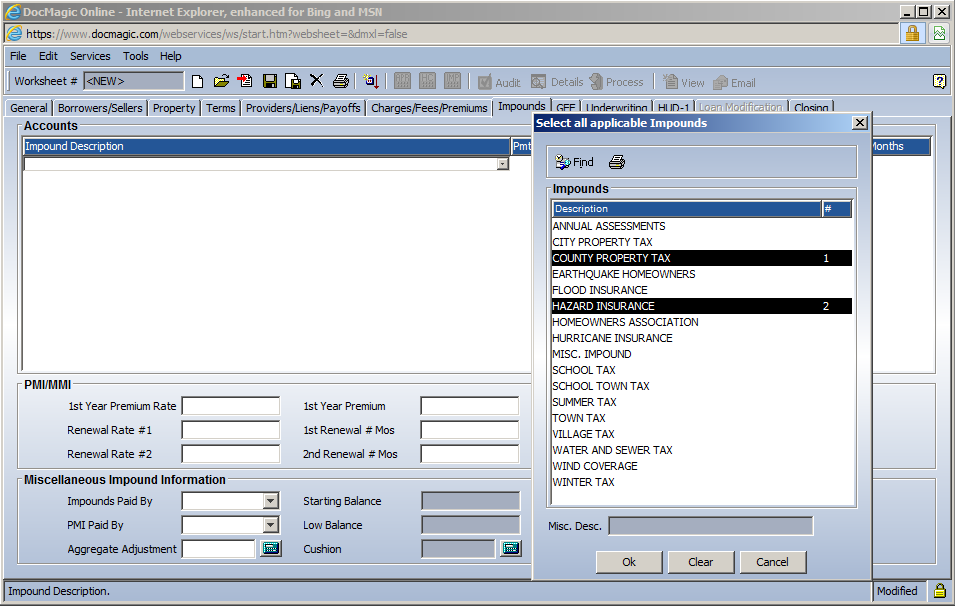

| 1. | Begin in DocMagic Online by selecting the Impounds Tab. Click on the white area under Impound Description to reveal the dropdown box. Select your Impound Descriptions. For this guide we are selecting County Property Taxes and Hazard Insurance. Click the OK button and the Descriptions are added to the worksheet. |

| |

| |

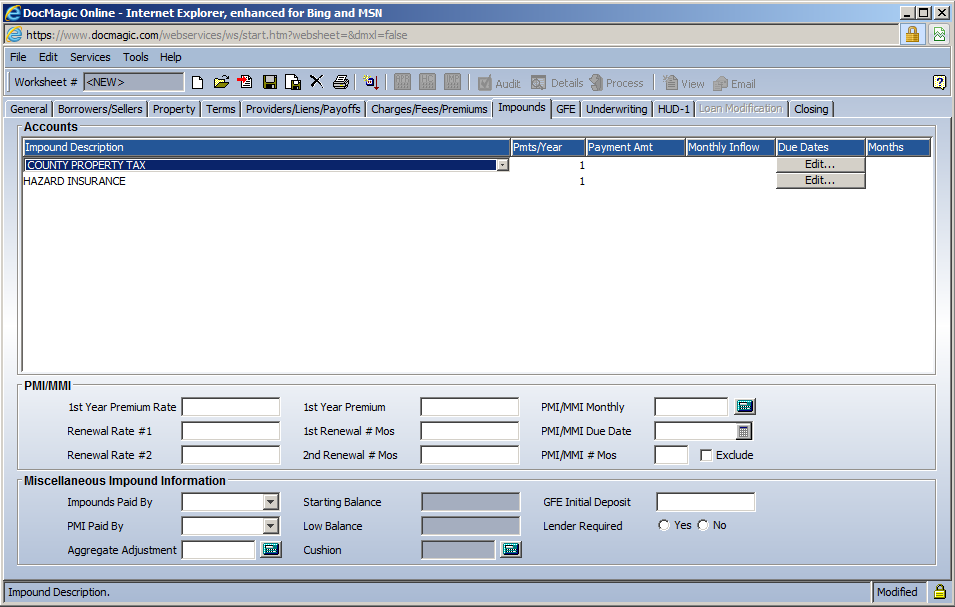

| 2. | Starting with the County Property Taxes enter the data for the taxes. In this next image we are entering 2 payments per year. If your taxes are due quarterly add a 4 in this section. |

| |

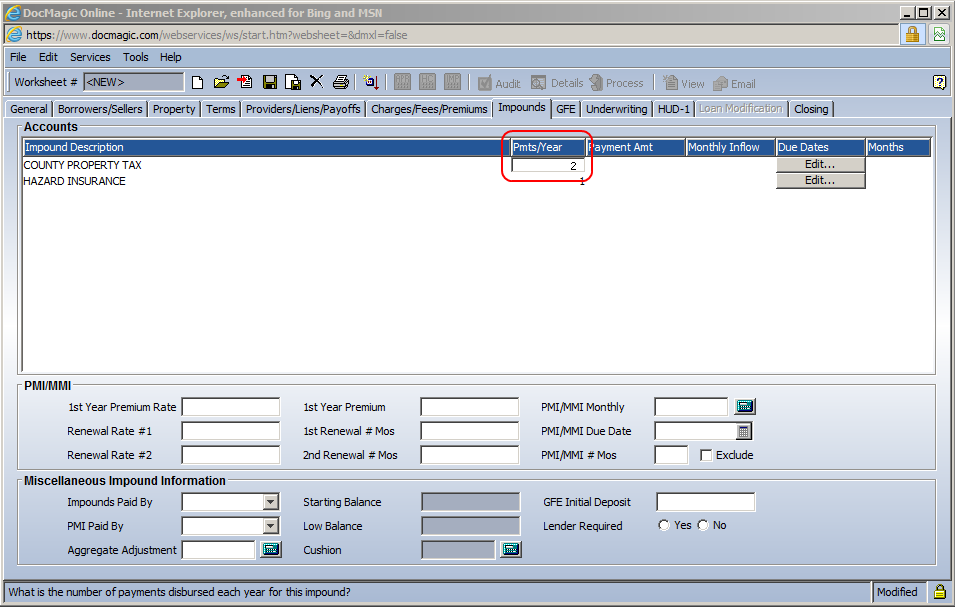

| 3. | In the next image we have added the amount that will be paid for the taxes. Since we there are two payments per year we have entered an amount that is ½ of the annual taxes. When we click in the Monthly Inflow box DocMagic will automatically calculate the amount to be collected each month for the impound account. Click on the Edit button in the Due Dates section. |

| |

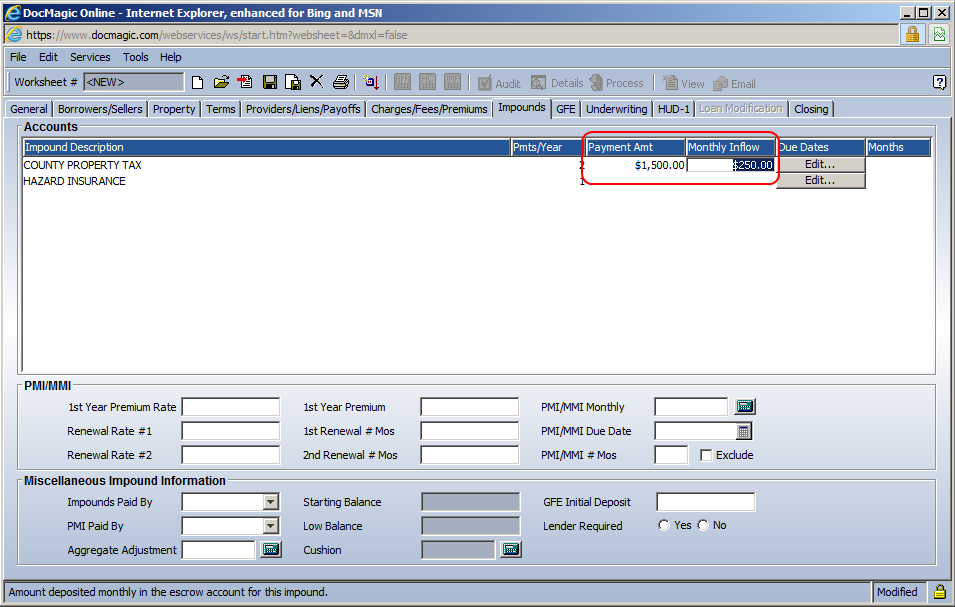

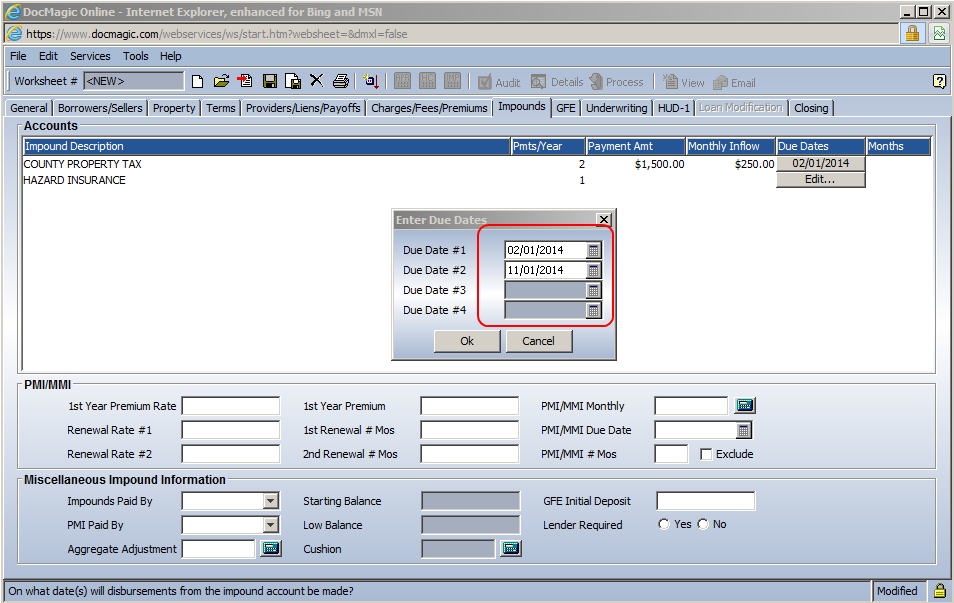

| 4. | Below we have added the Due Dates or Dates when the Impound will make the payment. Click the OK button and click into the Months section to have DocMagic calculate the amount of months that should be collected to begin the Impound account. |

| |

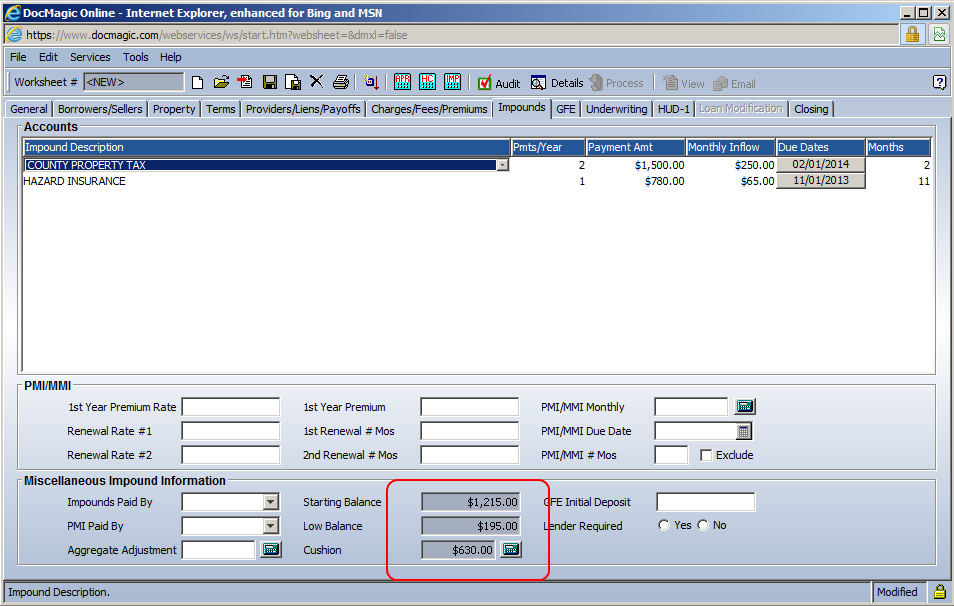

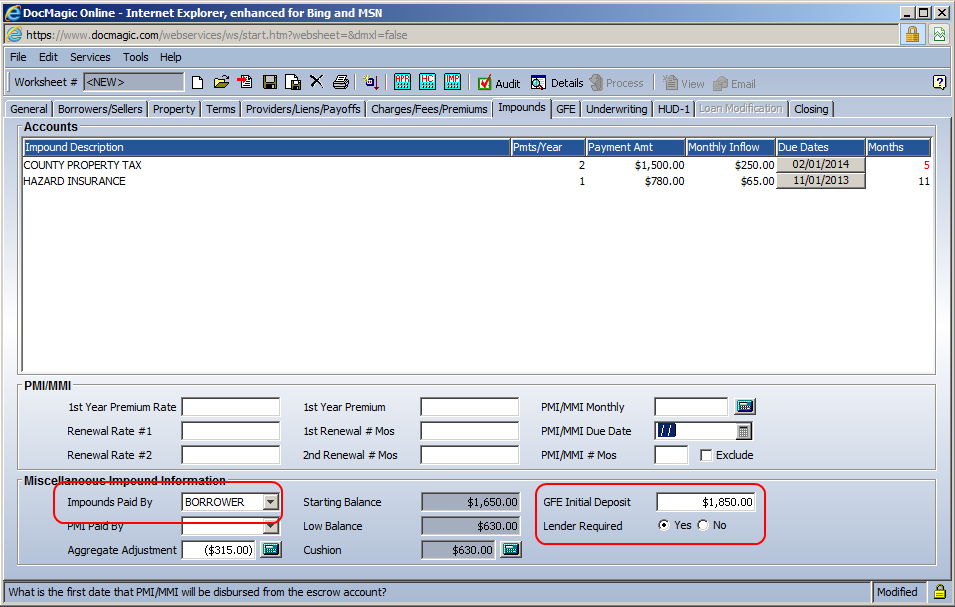

| 5. | Below we have added the Impound information for the Hazard Insurance. Now it is time to review Starting Balance, Low Balance and the Cushion. |

| |

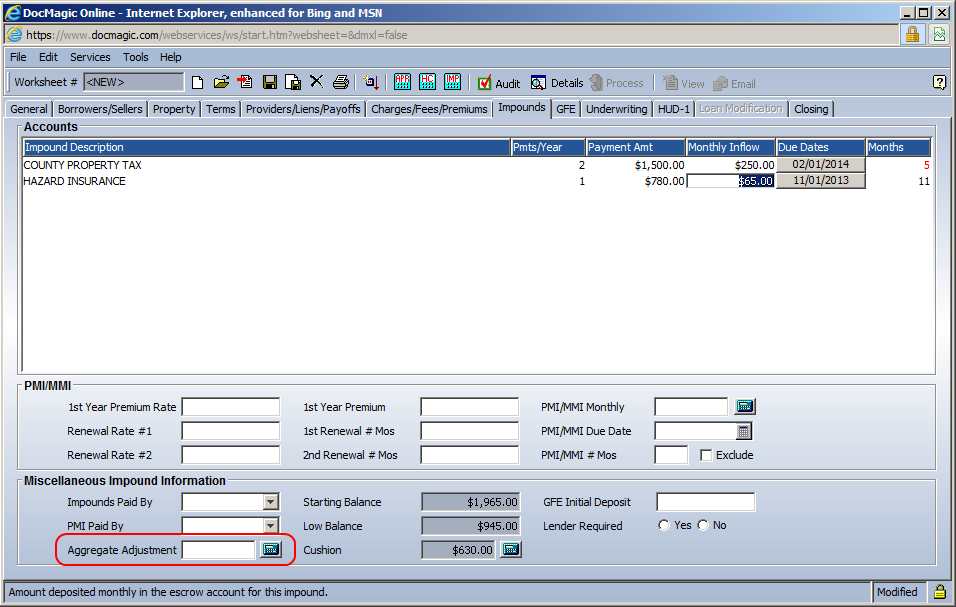

| 6. | Click on the Aggregate Adjustment calculator when your low balance exceeds your cushion. |

| |

| |

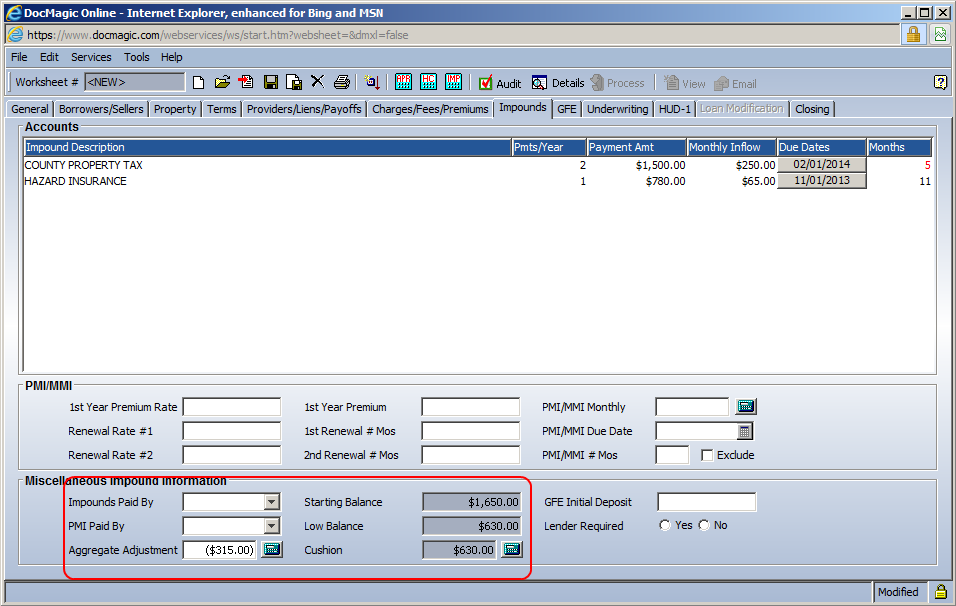

| 7. | You must select who the Impounds are paid by and enter yes or no for Lender Required. If you are processing closing documents then add the GFE Initial Deposit amount. |

| |