The lasting value of eNotes goes far beyond savings

Electronic promissory notes (eNotes) are transforming mortgage closings. While they do considerably reduce costs, with some lenders reporting savings of nearly $450 per loan, their full impact emerges in borrower satisfaction, operational efficiency, security, and speed. For lenders, investors, and settlement providers, eNotes represent a smarter, more reliable way to do business—one whose value can’t be measured in dollars alone.

Drive efficiency across operations

Digital notes are considered direct-from-source data, eliminating many of the manual touch points that introduce risk and consume staff time.

Post-closing teams, in particular, describe eNotes as transformative. Instead of scanning stacks of paper or validating data by hand, they can rely on automated workflows that shorten turnaround times. With fewer missing signatures or duplicate entries, lenders see stronger quality control and can recognize gains from loan sales more quickly.

Accelerate speed to funding

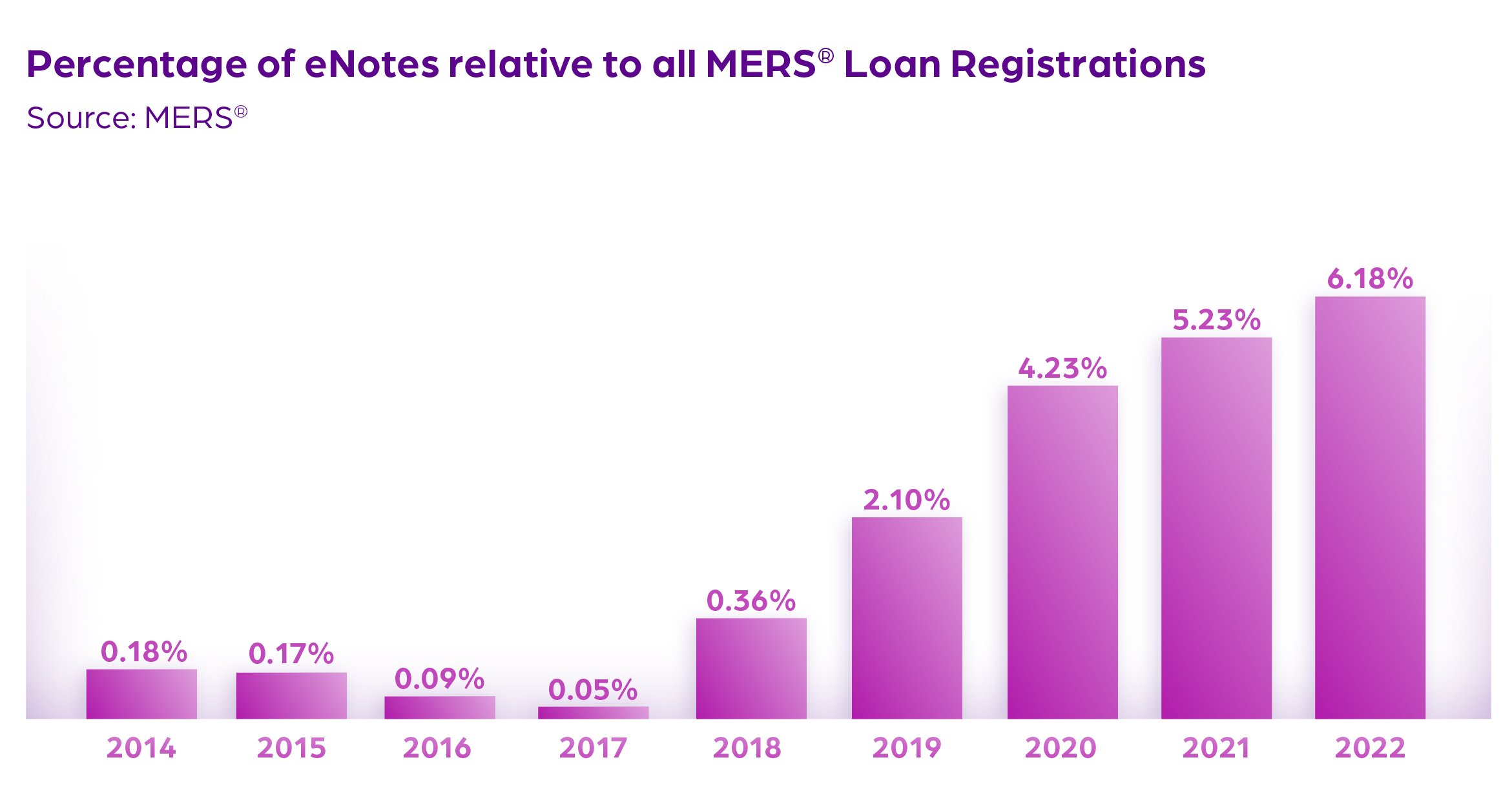

Paper processes often leave lenders dependent on shipping schedules, third-party logistics, and manual certification. eNotes return control to lenders. Once executed, an eNote is immediately registered with the MERS® eRegistry, making it accessible in real time.

In practice, this compresses the interval between closing and funding, giving lenders faster certainty and freeing capital. Just how great are the time savings? According to Fannie Mae, lenders delivering more than 25% of their loan volume as eNotes shortened the average interval between closing and funding by up to five days. Meanwhile, a Freddie Mac case study found that one lender reduced dwell time by 57% while also reducing errors by 80%. Together, these results show that eNotes don’t just cut costs, they also return valuable time to lenders and investors alike.

Strengthen security and peace of mind

A paper note can be lost, altered, or destroyed. An eNote cannot. Digital notes are sealed with tamper-evident technology that leaves an unmistakable trail if altered. Stored in secure electronic vaults (eVaults) and tracked through the MERS eRegistry, eNotes maintain their integrity throughout their lifecycle.

Transfers between eVaults are instantaneous and safe, eliminating the risks of physical shipping. For borrowers, this means peace of mind that their records are protected. For lenders, it ensures collateral remains secure and enforceable.

A value beyond measure

For lenders weighing their next steps, the message from peers is clear: the true value of eNotes lies in the better experiences, stronger operations, and greater confidence they deliver every day.

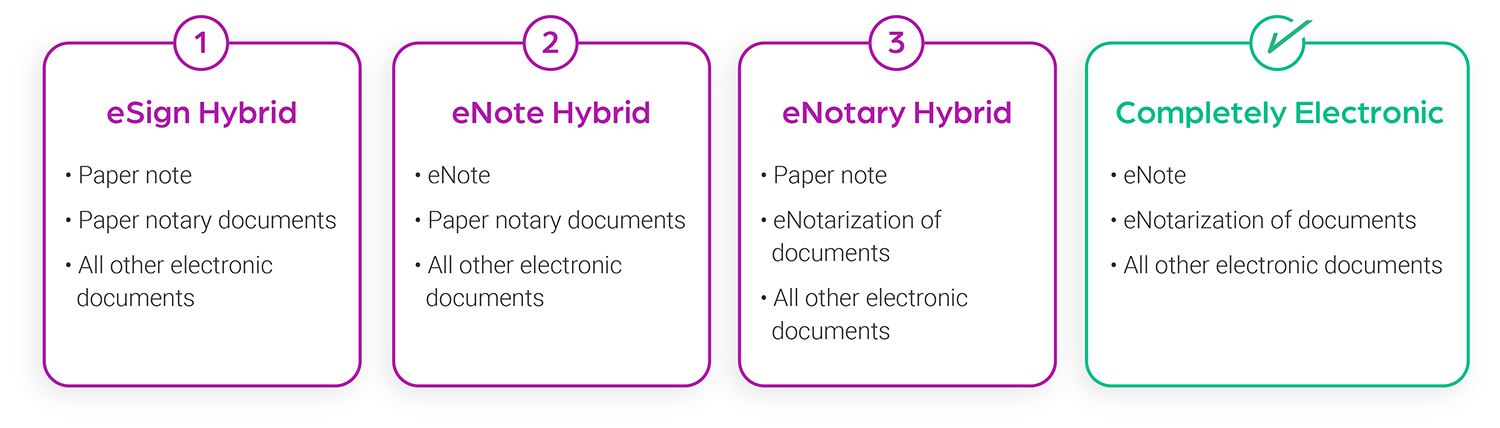

.jpg) Sommerville shares the reasons why lenders should consider the phased approach, and we delve into various

Sommerville shares the reasons why lenders should consider the phased approach, and we delve into various