Compliance Newsletter - January 2024

DocMagic’s 2023 in review: Pioneering the future of digital mortgages

As we reflect on the milestones that shaped the mortgage industry in 2023, we’re proud to say that our initiatives over the past year continued to support the success of our current and future customers in the digital mortgage space. We were excited to see you all at different industry events throughout the year and look forward to interacting with you further in 2024.

If you’d like to learn more about any of our solutions below, we’d love to chat with you. Next, let’s delve into the key highlights that define DocMagic’s impactful journey throughout the past year.

ADA-Compliant Loan Documents

Our ADA-compliant loan documents initiative marked a significant step toward creating a more accessible mortgage industry, prioritizing equality for individuals with disabilities. These dynamic, data-driven documents feature ADA metadata tags for clear structure and content comprehension.

Widely adopted by major financial institutions, these documents streamline processes, improve customer support, and ensure a measurable ROI. Beyond immediate benefits, ADA compliance aligns with regulatory standards, fostering inclusivity and mitigating legal risks for lenders.

A Game-Changer in Digital Auto Notes: eChattel for Auto Financing

In the auto financing space, DocMagic’s SmartSafe® eVault solution now includes eChattel functionality, offering a host of advantages for organizations that offer financing for products in addition to mortgages. eChattels are to auto financing what eNotes are to the mortgage space—an electronic purchase agreement.

This functionality allows lenders to efficiently manage and uphold security interests in financed automobiles and other products like large equipment and solar leases, reducing cycle times, enhancing collateralization efficiency, and ensuring compliance for digitally signed documents throughout the loan process.

SmartREGISTRY® eNote Platform Enhancements

DocMagic’s SmartREGISTRY proprietary eNote registry solution introduced additional intuitive features and enhancements to further streamline functionality in 2023. This platform directly integrates with MERS® to streamline eNote registration and simplifies secure, expedited eNote transfers, supporting a 100% paperless digital mortgage process.

Aligned with SmartSAFE eVault technology, the SmartREGISTRY solution facilitates access, delivery, storage, and management of electronic loan files in real time. Integrated with our comprehensive eClosing solution, it continues to lead the mortgage industry toward a seamless digital future.

QR Code Technology for Document Management

This past year, we also introduced a groundbreaking enhancement to our document generation capabilities—QR code technology. This innovation unlocks a world of possibilities beyond standard URL information. Our QR codes seamlessly integrate with document generation data, eSignature details, version control, and more.

Our QR codes also bridge the gap between physical mortgage documents and digital records, allowing quick retrieval of selected data through a simple scan. This facilitates document validation and version control and enhances the overall document-related information management process.

Accelerating the Loan Process with Print Fulfillment

In a move to increase unparalleled flexibility, we introduced Saturday and same-day print fulfillment features to expedite document delivery. This has been extremely valuable to print fulfillment clients as they realize that the ability to provide high quality loans is coupled with the propensity to deliver these loans to borrowers efficiently and quickly.

Enabled by our state-of-the-art Print Fulfillment Center, this feature adds a new dimension to the automated print fulfillment process. By allowing specific document packages to bypass the standard print queue, we’ve empowered customers to accelerate the loan process further and meet regulatory requirements with ease.

As we step into 2024, DocMagic stands at the forefront of innovation, reshaping the mortgage industry and leading the way into a digital future.

Related Content:

Enhanced integration of Empower LOS and DocMagic supports home equity, wholesale channels

Today, we're excited to post that Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, announced significant enhancements to the integration between the comprehensive Empower® loan origination system (LOS) and DocMagic’s document generation solution.

DocMagic, a leader in fully compliant loan document generation and comprehensive eMortgage services, debuted its native integration with the Empower system last year, making it seamless for retail mortgage lenders who use the Empower system to order initial and closing disclosures from DocMagic without having to build a custom connection. As a result of the latest enhancements to the integration, DocMagic services are now also available for wholesale and home equity originations in the Empower system.

“It’s really significant when two best-in-class vendors like Dark Matter and DocMagic integrate their products so customers no longer have to build out custom integrations — now it’s a true union,” said Rich Gagliano, Dark Matter Technologies’ chief executive officer. “We’re taking that value and convenience even further by bringing it to multiple origination channels.”

“We are thrilled to strengthen our collaboration with Dark Matter, offering top-tier documentation, compliance and eServices while also providing customers of the Empower system exceptional support backed by our award-winning customer service,” said DocMagic President and CEO Dominic Iannitti. "We look forward to continuing to integrate our two services further, supplying our proprietary ClickSign®, eNotary and Total eClose™ capabilities.”

DocMagic and Vesta join forces to enhance digital workflow efficiency

We're proud to announce that we've partnered with Vesta, a new and innovative mortgage loan origination system (LOS) and software-as-a-service (SaaS) company, to provide shared clients with automated document generation and automated regulatory compliance during the mortgage origination and closing process.

Dominic Iannitti, president and CEO of DocMagic, stated, "DocMagic is thrilled to announce its integration with Vesta's LOS, which will empower our lender clients with the potent benefits of digital lending automation throughout the entire loan lifecycle. Both of our solutions are thoughtfully designed as SaaS models and were purposefully crafted for exceptional flexibility, customizability, and cost-efficiency. This aligns perfectly with our common objective of minimizing origination and closing costs."

The companies’ newly integrated systems streamline the mortgage document generation and closing processes, ensuring compliance, and delivering an enhanced customer experience while reducing costs. The flexible APIs DocMagic and Vesta offer allow lenders to integrate tightly with many data points, thus minimizing manual tasks. This results in faster document processing, a paperless process, improved data integrity, and the elimination of errors that could lead to non-compliance. As both companies continue to release next-generation solutions, the partnership will only deepen.

Mike Yu, CEO of Vesta, added, "We are thrilled to be partnering with DocMagic to seamlessly deliver a comprehensive and compliant document generation and eclosing experience. We firmly believe that this integration will not only create a more streamlined origination process but also enhance the overall experience for lenders and borrowers alike."

Through DocMagic, lender clients using the Vesta LOS will benefit from increased workflow automation and compliance with dynamic state and county-level regulations. Additionally, through Vesta's LOS, users can seamlessly initiate document generation and automate compliance-intensive tasks. This interface focuses on total workflow automation, creating a smoother and more efficient lending experience for borrowers.

Vesta's next-generation LOS is designed to support digital automation for the entire origination process, catering to lenders of all sizes and enhancing the mortgage financing experience for borrowers. The platform's no-code workflow creation model and flexible decision-making engine empower lenders to configure their own business logic directly within a user-friendly web application, reducing the need for costly developer resources.

DocMagic Appoints Chris Lewis Director of Sales

Today, we're proud to announce the promotion of Chris Lewis to the role of Director of Sales. Chris is tasked with building on DocMagic’s success as a market leader while also driving strategic sales initiatives for the company’s new innovations.

As the Director of Sales, Chris is spearheading a pivotal initiative. His primary goal is to lead a team of subject matter experts in offering a consultative approach. This approach assists lenders of all sizes in realizing the cost-saving benefits and operational efficiencies of eClosings, which are becoming more prevalent in the industry. Furthermore, Chris and his team are committed to highlighting the exceptional document generation and compliance capabilities offered by DocMagic.

“Chris’ outstanding leadership style and extensive experience make him the ideal choice to support DocMagic as we strive to deliver best-in-class mortgage technology solutions for lenders,” said Dominic Iannitti, President and CEO of DocMagic. “We are delighted to welcome Chris into this strategic role, as we seize unique opportunities in the marketplace and expand our innovative offerings in digital lending.”

Chris has been an integral member of DocMagic's sales team since 2016, amassing over 25 years of invaluable industry experience. This extensive background equips him with a rare combination of deep domain knowledge and a profound understanding of how to deliver meaningful value to lenders.

"I am eager to offer our comprehensive solutions to clients, striving to provide a genuine partnership experience that enhances overall client engagement," Chris expressed. "With DocMagic's history of leadership in the market spanning over 35 years, and the growing prevalence of eClosings, I eagerly anticipate collaborating with lenders to create increased value for both themselves and their borrowers."

Integra Product Training

Integra is one of many LOS systems that works seamlessly with DocMagic’s exclusive, proprietary online data integration software.

Don't get charged multiple times for the same package. Click here.

Brian D. Pannell of DocMagic Wins HousingWire's Vanguard Award

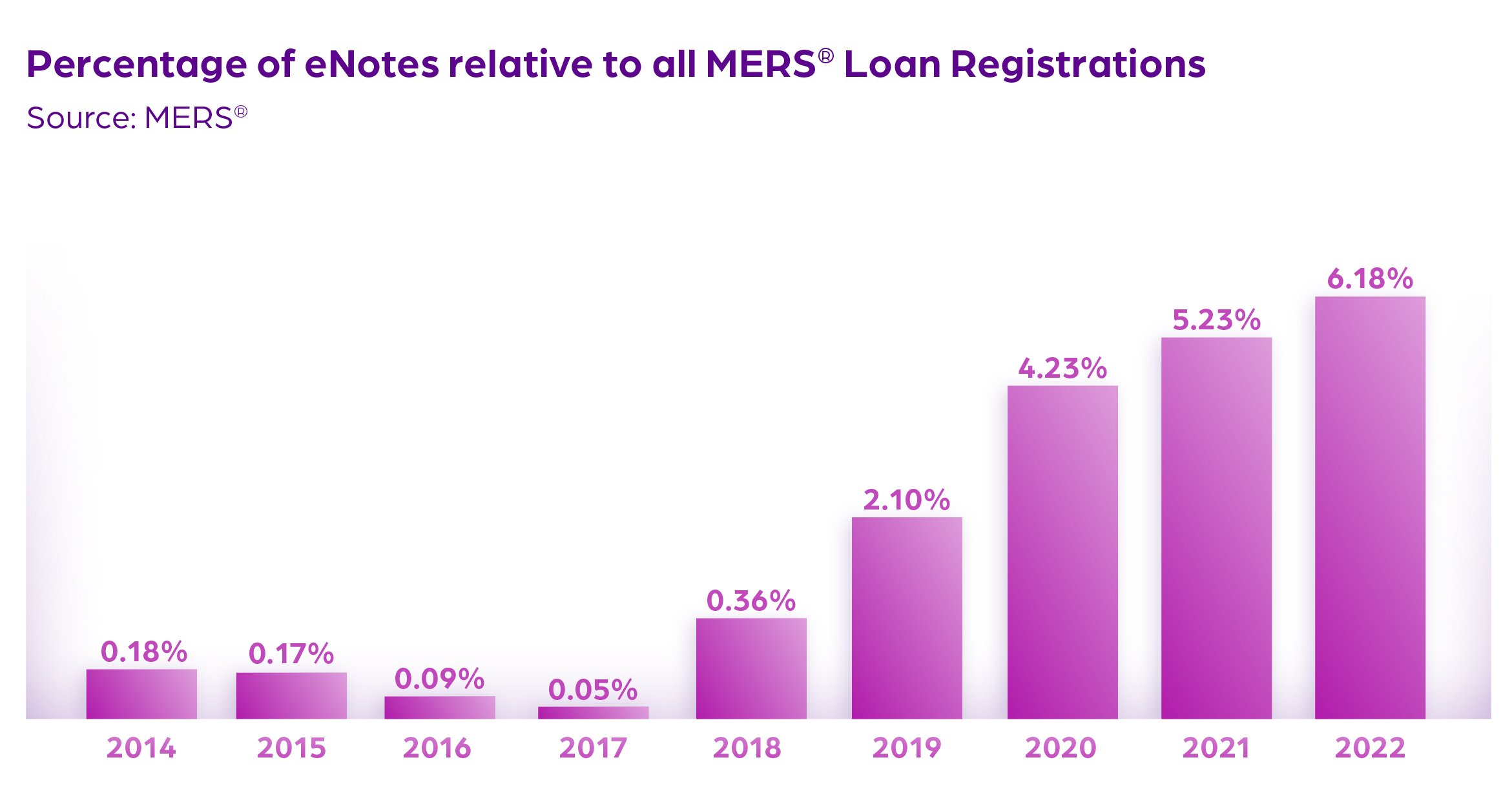

Today, we're proud to reveal that Brian D. Pannell, our Chief eServices Executive, has been honored with a prestigious Vanguard Award by HousingWire. This recognition, now in its ninth year, celebrates visionary leaders in the housing and mortgage finance industry, acknowledging their exceptional contributions and forward-thinking initiatives. Pannell's remarkable achievements in advancing eNote adoption among lenders have not only earned him this distinguished award but also propelled DocMagic to new heights.

A Trailblazing Technologist

Upon receiving the Vanguard Award, Pannell expressed his honor and commitment to DocMagic's role as a leader in innovative eMortgage technologies. He emphasized the company's dedication to advancing fully automated originations alongside paperless eClosings, thereby propelling the mortgage industry into the digital age.

“I am truly honored to receive HousingWire’s Vanguard award,” said Pannell. “The entire team at DocMagic is focused on maintaining our role as a leader in innovative eMortgage technologies. I am excited to be a part of this major movement and help DocMagic lead the charge for years to come.”

Pannell has long been a driving force behind eClosing adoption within the mortgage industry. His unwavering dedication and hands-on approach have led to increased efficiency for DocMagic's lender clients—one notable project spearheaded by Pannell resulted in a significant surge in eNote adoption among federal banks, investors, and lenders.

In fact, thanks to Pannell's tireless efforts, DocMagic has achieved a nearly 40% increase in eNote adoption among its banking clients in the last year alone.

This achievement aligns seamlessly with our overarching mission: to eliminate paper from the mortgage process and digitize workflows, from origination to closing. Considering Pannell's focus on the efficiencies of eNotes for eClosing, below, we'll focus on eNotes themselves and just why they've been such a focus for clients in the past year.

The Power of eNotes

Traditional paper notes are slow, costly, and vulnerable. Typically stored in fortified vaults to withstand disasters, paper notes require costly retrofits, such as fireproof walls and waterless sprinkler systems. One critical weakness of paper notes is that there's only one original copy, with no backup concept. Losing the original note renders any copies worthless, akin to a lost endorsed check.

Also, each time a paper note is shipped, the risk of loss or damage multiplies significantly. It passes through several physical handovers, from the warehouse lender to the investor and finally to the custodian. With each shipment, the expense and risk increase substantially.

In contrast, eNotes eliminate these risks. They cannot be lost because there's no single original record to misplace. Additionally, eNotes can be securely backed up, virtually eliminating the risk of loss.

Instead of worrying about holding the original note, in an eMortgage workflow, the concept of an authoritative copy is introduced. While multiple copies of an eNote can exist simultaneously, only one is designated as the authoritative copy, akin to the original paper promissory note. The MERS® eRegistry system, in conjunction with eVault technologies, determines the authoritative copy of the eNote. Specifically, the copy of the eNote stored within the MERS®-designated "Location" Rights Holder's eVault is considered the authoritative copy, ensuring the security and integrity of the digital document.

These security and efficiency reasons—alongside many more—are why Pannell has guided his clients to further eNote adoption, leading to this prestigious award and recognition from HousingWire.

Celebrating Innovative eMortgage Solutions

Pannell's impressive credentials and extensive experience underscore his ability to forge critical technology and business relationships within the industry, leading clients to the perfect eMortgage solutions. DocMagic's industry-leading solutions include a variety of digital lending products, from ClickSign®, eNotary services, and eClosing to eNote generation and secure eVaults, such as SmartSAFE®.

HousingWire's annual Vanguard awards recognize leaders across various sectors of the housing economy, including residential mortgage lending, servicing, real estate, and fintech. The 2023 Vanguard winners, including Pannell, will be honored at a ceremony during this year's HW Annual Conference in Dallas, Texas in mid-October. Their achievements will also be featured in the October/November issue of HousingWire and will continue to receive recognition on HousingWire.com.

Pannell's recognition with the Vanguard Award serves as a testament to his outstanding leadership and contribution to the mortgage industry's digital transformation. Under his guidance, DocMagic continues to lead the charge in innovative eMortgage technologies, shaping the future of mortgage origination and closing processes.

Compliance Newsletter - September 2023

California Passes Remote Online Notarization Bill

This post is adapted from a detailed update on the new SB 696 bill in our Compliance Edge publication authored by Gavin T. Ales, Chief Compliance Officer at DocMagic.

On Saturday, September 30th, the California governor signed a bill into law, SB 696, that paves the way for legalization of remote online notarizations (RON) by California notaries. The groundbreaking piece of legislation has stipulations to review the technological requirements for RON, study laws of other states governing remote notarization, and determine appropriate regulations and rules necessary to enable the conduct of remote notarizations.

However, what sets this legislation apart is its forward-looking approach, with its full scope perhaps not becoming effective until years after its passage.

The legislation also requires the Secretary of State to conduct a Technology Project to assess the technological requirements for RON. The bill would enable remote notarizations within the state at the completion of the Technology Project, or in accordance with rules passed as part of that process, or in the event the project is not completed by the later effective date, would authorize remote notarizations on January 1, 2030. The new law will include some of the common, familiar requirements for remote notarization that other states have also included with their legislation. Unlike many other states, though, California did not simply adopt a version of the Revised Uniform Law on Notarial Acts (published by the Uniform Law Commission). The law will require credential analysis and identity proofing, a requirement for keeping an electronic journal for a period of 10 years, which may be done with the notarizing platform or another registered depository, and use of an image of the notary public’s electronic signature with an electronic notarial certificate that includes a notation that the notarial act was completed via audio-video communication technology. Remote notarization platforms and journal depositories will be required to seek approval from the secretary’s office prior to offering such services in the state, and approval cannot be sought until the Technology Project is completed.DocMagic will continue to monitor developments on remote notarizations in California as the Secretary of State’s office proceeds through the steps for completing the required Technology Project.

Related Content: