Ask the eClosing Team: Unlocking the potential of hybrid eClosings

When a lender comes to us requesting a digital mortgage closing transformation, we often recommend a “crawl, walk, run” strategy: in other words, we encourage them to transition through various stages of hybrid electronic closings (eClosings) before going 100% digital.

This phased approach is often helpful for newly digital lenders, but we still have clients who approach us with a desire to go full eClosing from the start.

Our eClosing Team expert, Leah Sommerville, firmly advocates for a phased approach to implementing eClosing for all lenders—particularly the adoption of hybrid eClosings with an experienced vendor. In this interview, .jpg) Sommerville shares the reasons why lenders should consider the phased approach, and we delve into various forms of hybrid eClosings and provide insights into measuring your ROI as you implement hybrids.

Sommerville shares the reasons why lenders should consider the phased approach, and we delve into various forms of hybrid eClosings and provide insights into measuring your ROI as you implement hybrids.

Q: First things first. Would you still recommend a phased eClosing approach for lenders, and why?

A: I wholeheartedly endorse the phased approach for all lenders. Waiting indefinitely for the perfect moment when every aspect of lending can be electronic is, unfortunately, a flawed strategy. The reality is that not every loan can be purely electronic due to some lingering investor restrictions, geographical limitations, and other constraints.

However, a hybrid eClosing allows lenders to enjoy digital benefits now. They can see the increased efficiency, the quicker closings, and the increased cost savings. Borrowers today also expect a digital experience, from online applications to e-signing initial disclosures, and lenders should strive to align with these expectations.

Q: Why should lenders consider hybrid eClosing before going to 100% eClosing?

A: There are several compelling reasons why the phased approach, starting with hybrid eClosings, is a good choice.

- Empowering borrower document review: Hybrid eClosings allow borrowers to review documents ahead of the closing day, aligning with their digital journey and giving them more confidence in the process.

- Facilitating internal team familiarity: Implementing eClosings all at once can overwhelm internal teams within lending institutions. A phased approach eases the transition and allows teams to adapt gradually.

- Navigating compliance and MERS® membership: Setting up MERS® membership, a prerequisite for eNotes, can take 3-6 months. During this period, lenders can become accustomed to the digital workflow if they’re already using the first category of hybrid eClosing (see below).

- DocMagic's eDecision tool for compliance: If they’re using DocMagic to generate digital documents, lenders can start using our eDecision audit, described in our Loan Detail Report, to assess where notarization can be applied in advance of actually deploying an eNotarization solution. This ensures compliance and streamlines the evolution toward a complete eClosing workflow once they scale up.

- Meeting borrower expectations: Modern borrowers conduct most of their mortgage-related activities online. Providing a digital experience up to the closing stage is essential.

Q: What types of hybrid eClosings does DocMagic provide, and what do those categories involve?

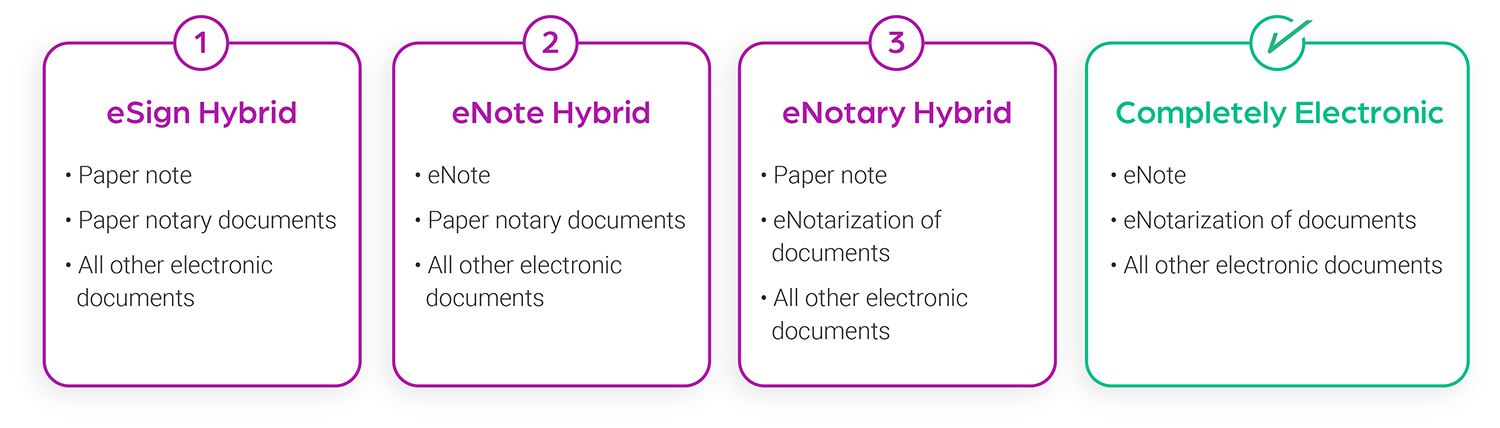

A: DocMagic offers a spectrum of hybrid eClosing options tailored to diverse lender needs:

With the first category of hybrid eClosing, eSigning (with DocMagic, that’s covered by our ClickSign® tool) is the focus. Borrowers can preview the closing package as soon as it’s generated, with about 90% of the package available for electronic signing. Notarization and wet signatures are still required for the promissory note and select documents, but they usually only amount to 3-4 pages as opposed to dozens.

Building on the first level, the second category of hybrid incorporates electronic notes (eNotes) stored in an eVault, facilitating quicker funding and seamless transfer to investors or warehouse lenders through integration with MERS®.

In the last category of hybrid, ancillary documents can be eSigned but eNotarization is also possible, reducing the need for wet signatures. Typically, only the promissory note requires wet signing in this type of hybrid. Also—and this is not always done, but it’s still possible—since the note doesn’t require notarization, the borrower could even print out the note at home, sign it, and re-upload it into the lender’s eClosing portal, facilitating an even faster certification process.

Each of these hybrid eClosing options offers varying degrees of efficiency and digitization, helping lenders transition gradually to a more advanced eClosing workflow.

Q: What are some key indicators that lenders can use to measure the ROI they want from hybrid eClosings?

A: Lenders can gauge the ROI of their hybrid e-closings by considering several metrics.

First, if eNotes are part of the hybrid workflow, measuring how quickly they are funded can show lenders just how significantly an eNote impacts efficiency and cost savings.

Evaluating the time borrowers spend at the closing table is also crucial. Hybrid eClosings often lead to much shorter sessions at the closing table, indicating a smoother process even without a 100% digital workflow.

Another strong ROI indicator is a decrease in undersigning errors, oversigning errors, and missed documents when lenders receive documents from the settlement agent. Less human error translates to cost savings and quicker closings overall.

Lastly, assessing borrower satisfaction with the hybrid eClosing experience is vital. Satisfied borrowers are more likely to recommend the lender's services and spread the word about quick, convenient closings.

Q: What recommendations do you have for lenders who still want to implement 100% digital eClosing from the start?

A: Definitely appoint a strong project stakeholder. A dedicated and experienced project stakeholder will lead the transition to full eClosing from planning to implementation. This individual should be the driving force behind the project, ensuring it reaches successful completion.

Also, be mindful and recognize that some benefits of eClosings may not be fully realized until reaching the 100% eClosing stage—therefore, know that lenders starting with hybrid may gain these benefits right away, while lenders going 100% digital may have to wait for MERS® approval or other independent organizations.

In the end, Sommerville emphasized that staying on track and avoiding delays is essential. It’s better to progress and adapt than to wait indefinitely and potentially fall off track—so whether you choose a phased approach with hybrid eClosings, or whether you pursue 100% digital from the start, getting started is the most important action to take.

Related Content: